- Passionate Income

- Posts

- Don't Want to Get Sued? Do This...

Don't Want to Get Sued? Do This...

This is how you avoid losing everything...

843 Words | 3 Min 31 Sec Read

Welcome to another issue of Passionate Income.

Today we’ll be discussing how you can protect yourself from losing everything as a digital business owner.

Let’s dive in.

This issue is sponsored by us - Passionate Income!

Just filmed a brand new video on how one of my students used my Faceless Page strategy to attract 900,000 followers. And the best part?

He now earns a full-time income. Click here to watch it on YouTube now.

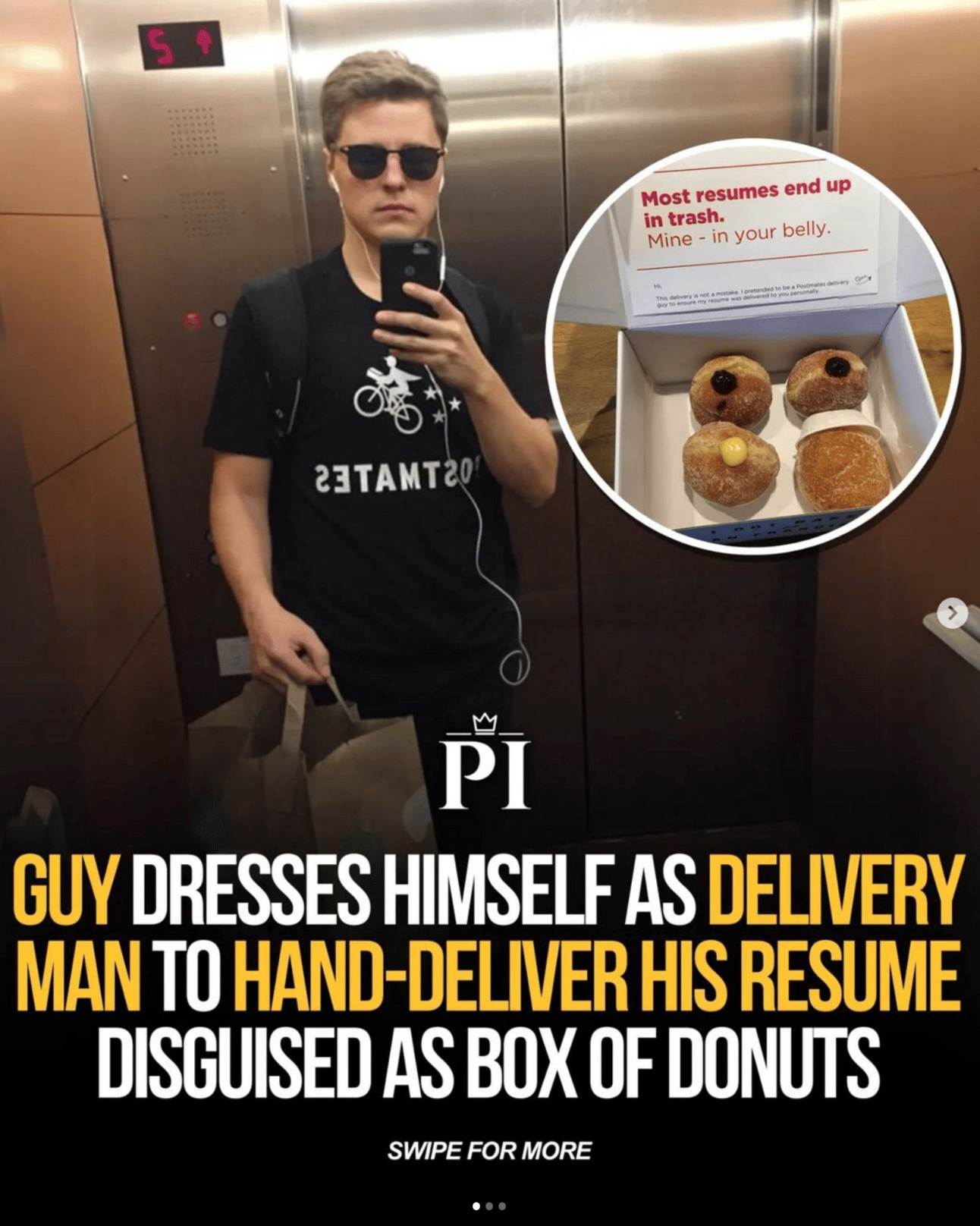

In the online business space, most guru types claim you should focus on generating sales when first getting started (versus worrying about your logo, incorporating your company, etc.).

While this is true in general, what it doesn't take into account is the tiny - but very real - possibility you get sued by your very first customer or client.

In fact, even if you're not working with people, media and ad share business models (like my Faceless IG Page strategy cough cough) could also result in you getting sued for copyright infringement, etc.

In short, while getting sued early in business is rare, that doesn't mean it's non-existent. And because of that, it's our opinion you should protect yourself.

Why?

Let's say you freelance and get hired to do graphic design for a website. But in the process of uploading new files, you accidentally delete their entire site.

Even better, let's say you're working from a cafe or airport and a hacker steals the password to your client's IG account using a key stroke logger.

And from there, let's say the hacker posts a bunch of casino affiliate links to their Page, resulting in Instagram permanently banning it.

Did you know that in both of these situations (and thousands of other similar ones), you could be held legally liable as part of a lawsuit?

And did you know that if you're not doing business as part of a company, the client can sue you for everything you own?

Last, did you know that if you get sued, lose the case and can't pay, the government can garnish your wages, freeze and seize your bank accounts, and/or put a lien on your property?

Pretty extreme for making an innocent mistake right?

Fortunately, all of this can be avoided by forming an LLC before going into business (while C and S Corps provide similar benefits, 99.9% of online entrepreneur types form LLCs because of how cheap and easy they are).

Without boring you to death with details you already know, the main upside of forming a company is that the governments (and therefore courts) consider it a separate "entity."

In plain English, having a separate entity means that if you're sued and lose, the person/company suing you would only be entitled to your company's assets. They would not, however, have any claim to your assets.*

*This is not legal advice. Generally speaking, if you commit a crime (e.g. fraud, negligence, etc.), you can be held personally liable for losses.

But legal protection from lawsuits isn’t the only reason to form a company.

Another perk of LLCs is their flexible tax structure.

Unlike corporations, which are subject to double taxation, LLCs typically benefit from pass-through taxation.

This means the business itself doesn't pay corporate income tax, and the profits (or losses) simply "pass through" to the individual members.

LLCs also provide flexibility in terms of ownership and management.

With an LLC, you have the freedom to structure your ownership and profit-sharing agreements without having to fill out a bunch of complicated forms.

Admittedly, this is only relevant if you'll be working with a partner. If not, you'll be the 100% owner and be 100% responsible for profits/losses.

And the best part?

Unlike when I created my first company, sites like LegalZoom now offer $0 LLC formation (as part of their most basic package, which is sufficient for 99% of online entrepreneur types).

Yes, you'll still have to pay the state's incorporation fee and a once-per-year registered agent fee.

While state fees range from $35 to $500, the highly popular state of Wyoming (my choice) charges just $102 to file and $60 to renew. In addition, registered agent fees average just $100 per year.

Given we're talking about protecting your car, home, furniture and potentially even wages and bank accounts, spending $200 to form an LLC before doing business is an absolute no-brainer in our book.

💡 Takeaway: Assuming you're not committing any crimes, LLCs can protect your personal assets from seizure in the rare case a client or customer sues you. Further, forming an LLC is both easy and low-cost, making it worth the small investment required to get started.

🎁 Resources:

Subscribe to my YouTube channel for more online business tips

Take my free Faceless Instagram Page course

See how my student gained 900,000 IG followers

Join my AI Newsletter - Geek AI

What'd you think of today's edition?

Reply back with a rating between 1 and 10 to let us know!